Entrepreneurial exits can represent the great harvest of your life's work. While the business sales process can be an emotional roller coaster, it can also be an exciting time in the lifecycle of your business. When it comes time to sell your company, having the right professional assistance through this difficult process is critical to maximizing the value of the organization that may have taken a lifetime to build.

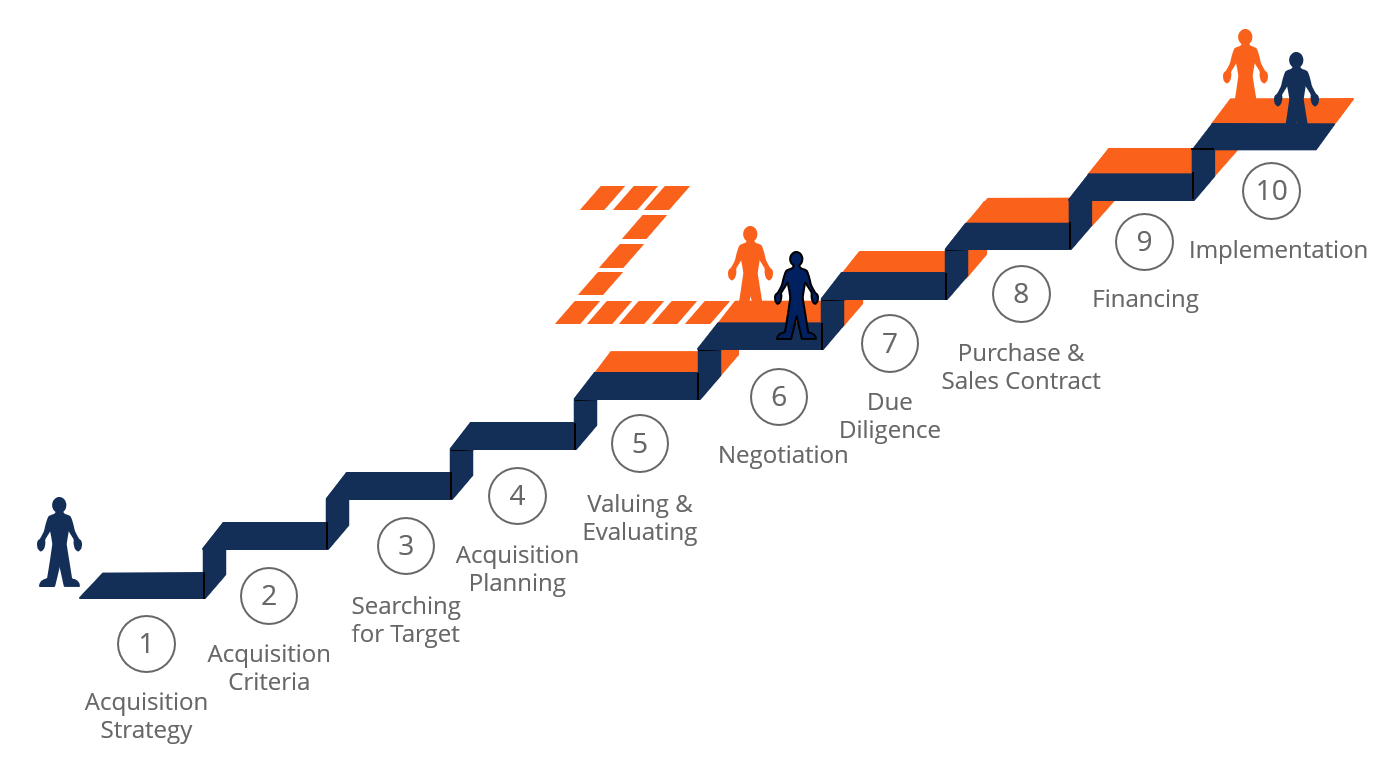

The acquisitions process has many steps and can often take anywhere from 6 months to several years to complete. Selling your business can be painstaking. Having the right professionals on your side of the deal can make it a lot easier.

One of the most complicated steps in the M&A process is properly structuring the deal. There are many factors to be considered, such as antitrust laws, securities regulations, corporate law, rival bidders, taxes, accounting issues, contacts, market conditions, forms of financing, and specific negotiation points in the M&A deal itself.

In M&A deals, there are typically two types of acquirers: strategic and financial. Strategic acquirers are other companies, often direct competitors or companies operating in adjacent industries, such that the target company would fit in nicely with the acquirer's core business. Financial buyers are institutional buyers such as private equity firms that are looking to own, but not directly operate the acquisition target. Financial buyers will often use leverage to finance the acquisition, performing a leveraged buyout (LBO).

The vast majority of acquisitions are competitive or potentially competitive. Companies normally have to pay a premium to acquire the target company, and this means having to offer more than rival bidders. To justify paying more than rival bidders, the acquiring company needs to be able to do more with the acquisition than the other bidders in the M&A process can (i.e., generate more synergies or have a greater strategic rationale for the transaction).

When it comes to valuing synergies, there are two types of synergies to consider: hard and soft. Hard synergies are direct cost savings to be realized after completing the acquisition process. Hard synergies, also called operating or operational synergies, are benefits that are virtually sure to arise from the acquisition such as payroll savings that will come from eliminating redundant personnel between the acquirer and target companies. Soft synergies, also called financial synergies, are revenue increases that the acquirer hopes to realize after the deal closes. They are soft because realizing these benefits is not as assured as the hard synergy cost savings.

Companies choose to grow by acquiring others to increase market share, to gain access to promising new technologies, to achieve synergies in their operations, to tap well-developed distribution channels, to obtain control of undervalued assets, and a myriad of other reasons. But acquisition can be risky because many things can go wrong with even a well-laid plan to grow by acquiring: Cultures may clash, key employees may leave, synergies may fail to emerge, assets may be less valuable than perceived, and costs may skyrocket rather than fall. Still, perhaps because of the appeal of instant growth, acquisition is an increasingly common way to expand.

Deal Structuring

One of the most complicated steps in the M&A process is properly structuring the deal. There are many factors to be considered, such as antitrust laws,

securities regulations, corporate law, rival bidders, taxes, accounting issues, contacts, market conditions, forms of financing, and specific negotiation

points in the M&A deal itself.

We help identify key risks and rewards throughout the acquisition life cycle, even for the most complex deals. We help you align deals with your strategic business objectives, maintain compliance and enhance value from integration and potential upside opportunity. Our team of specialists helps you focus on the key questions during the critical stages of planning and executing an acquisition.

We blend sophisticated capital markets expertise, with local market presence to negotiate customized financing packages that allow our clients to achieve their goals.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

This insight into current market practice ensures we negotiate the best deal for you throughout your transaction. Our team has the experience to help guide and support management teams through the process. We advise management teams on structuring, valuation, financing and tax planning and assist them to approach the vendor with a credible bid.

Our team can engage with you to:

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.