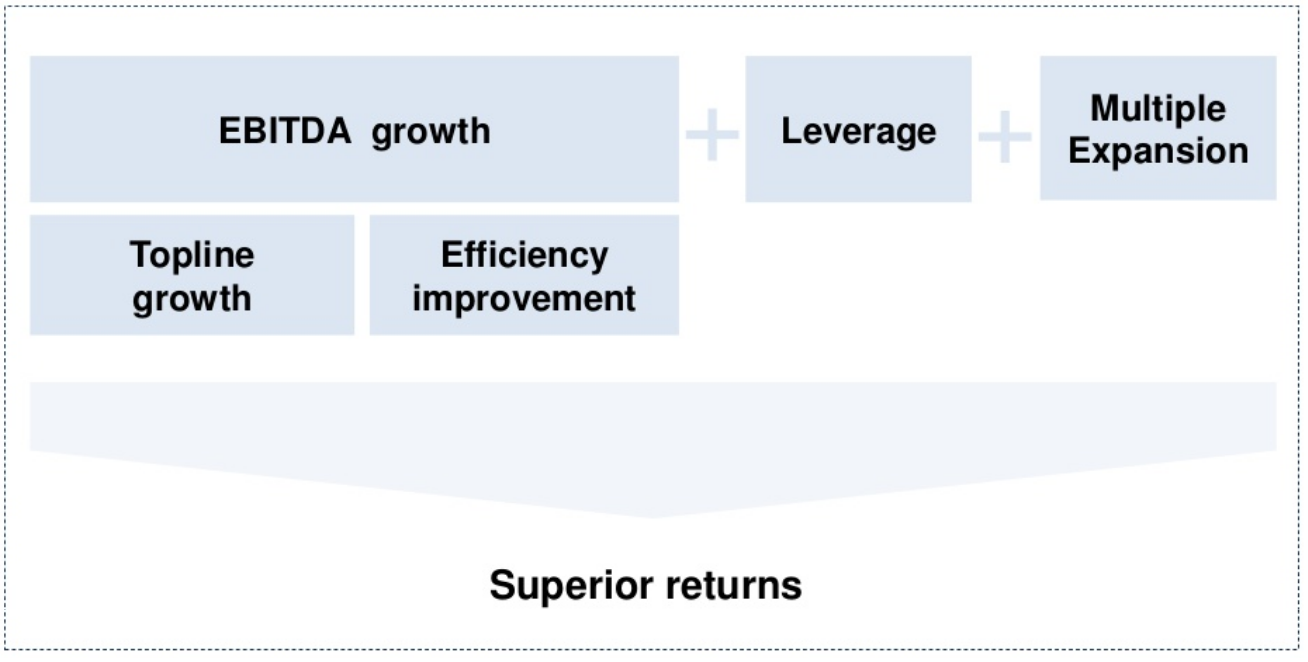

In today's highly competitive market, spotting value creation opportunities as well as understanding risk pre acquisition is key to driving

value on completion and under ownership. Our Private Equity team works with our specialist sector teams which enables us to provide insights across all

business sectors. This in turn helps facilitate the identification of strategic opportunities for buyouts.

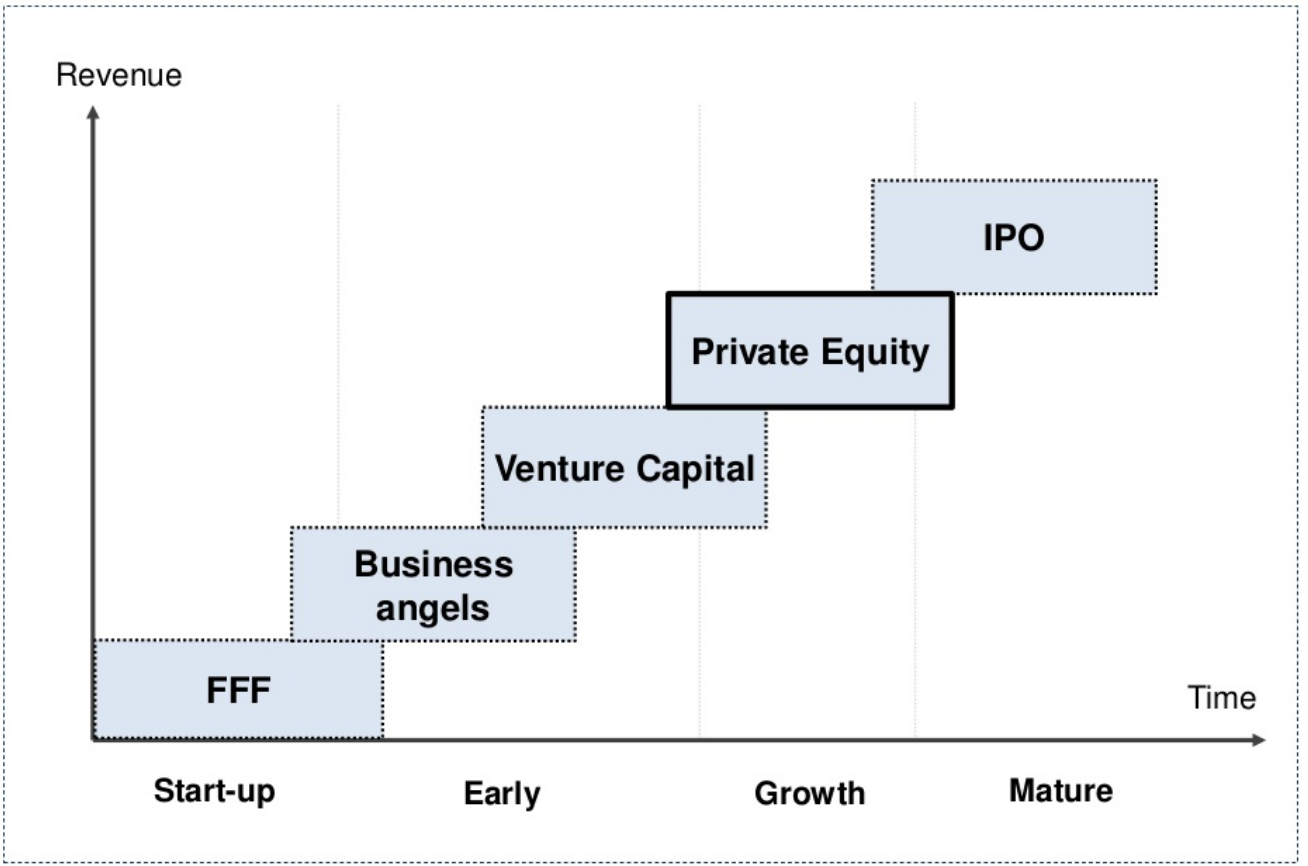

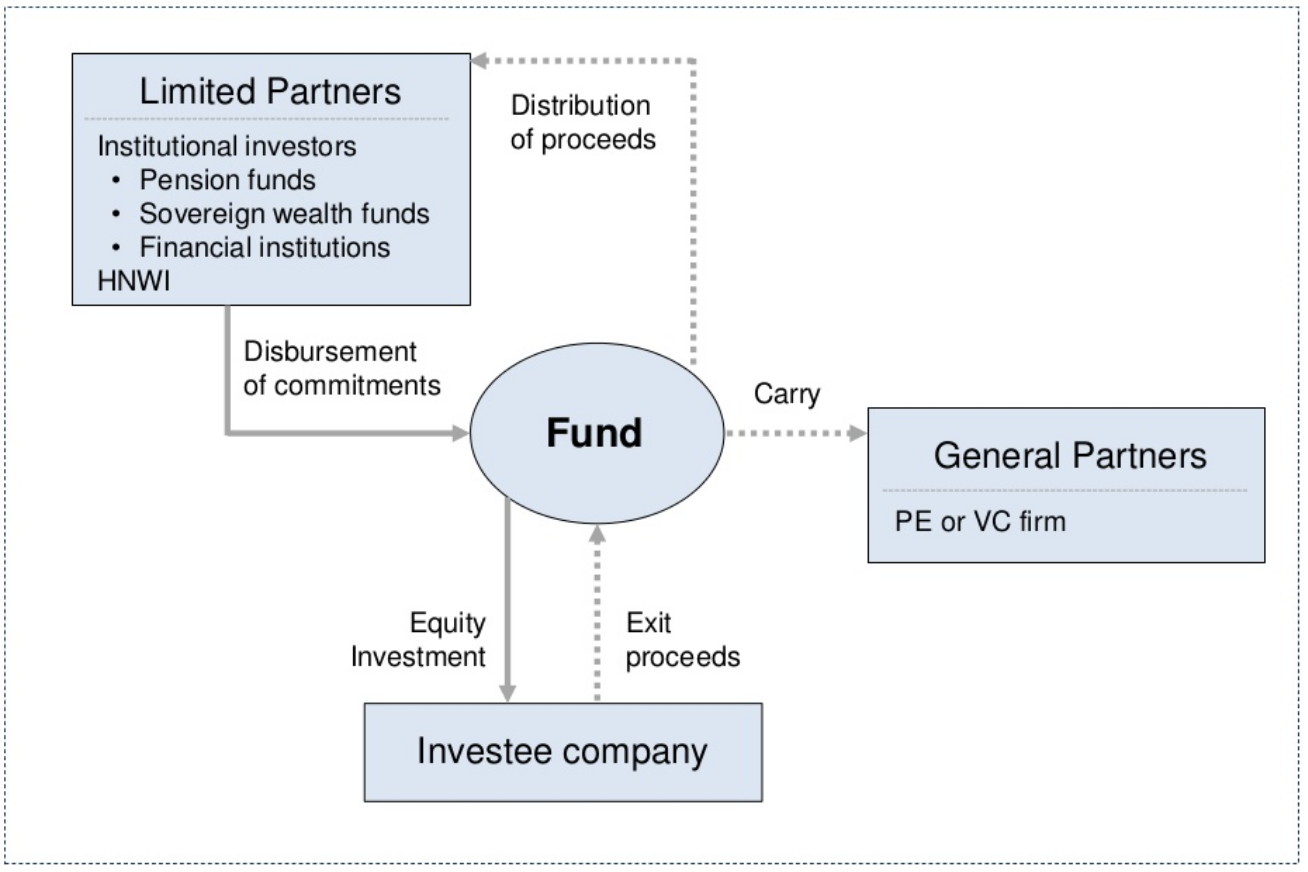

As part of fund raising, Venture Capital firms provide high growth potential with finance and business skills to explore market opportunities. To deal with high risk environment, an equity syndicate involves two or more VC firms taking an equity stake in an investment, either in the same investment round or, more broadly defined, at different points in time.

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.