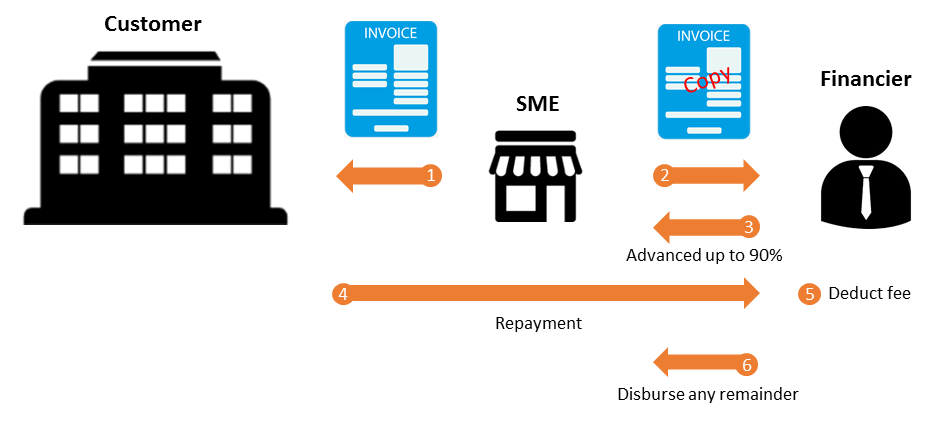

Invoice discounting is a form of alternative finance in which business owners have an agreement to sell their unpaid invoices (accounts receivable) to a third party.

Businesses, therefore, gain access to all the money in advance by leveraging their sales ledger (minus the lender's fee), thereby injecting their business with much-needed cash flow. It's an increasingly popular means of improving the Working Capital Cycle (WCC).

Invoice discounting is flexible and adapts to the changes and growth of a business which is why many consider it to be a better fit for their business when compared with more traditional forms of finance such as loans and overdrafts.

Our capital sources provide solutions across the spectrum, from fully amortizing long-term debt and non-recourse construction transactions to a highly leveraged mezzanine or bridge deal. Because of the strength of our existing relationships with funding sources, we are often able to help facilitate debt placement opportunities at more favorable rates and terms than many of our clients could obtain independently. We blend sophisticated capital markets expertise, with local market presence to negotiate customized financing packages that allow our clients to achieve their goals.

Invoice discounting may be suited to your business if the following applies:

Our experienced team build robust, transparent financial models covering all circumstances and across a wide range of sectors. Our approach is to start with a clear understanding of the situation and design a bespoke model using proven methodologies and techniques. The advantages of our models include creating outputs and usability that are designed specifically for the user, as well as providing the flexibility of assumptions to perform sensitivity analysis.

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.