What Is a Leveraged Buyout? (LBO)?

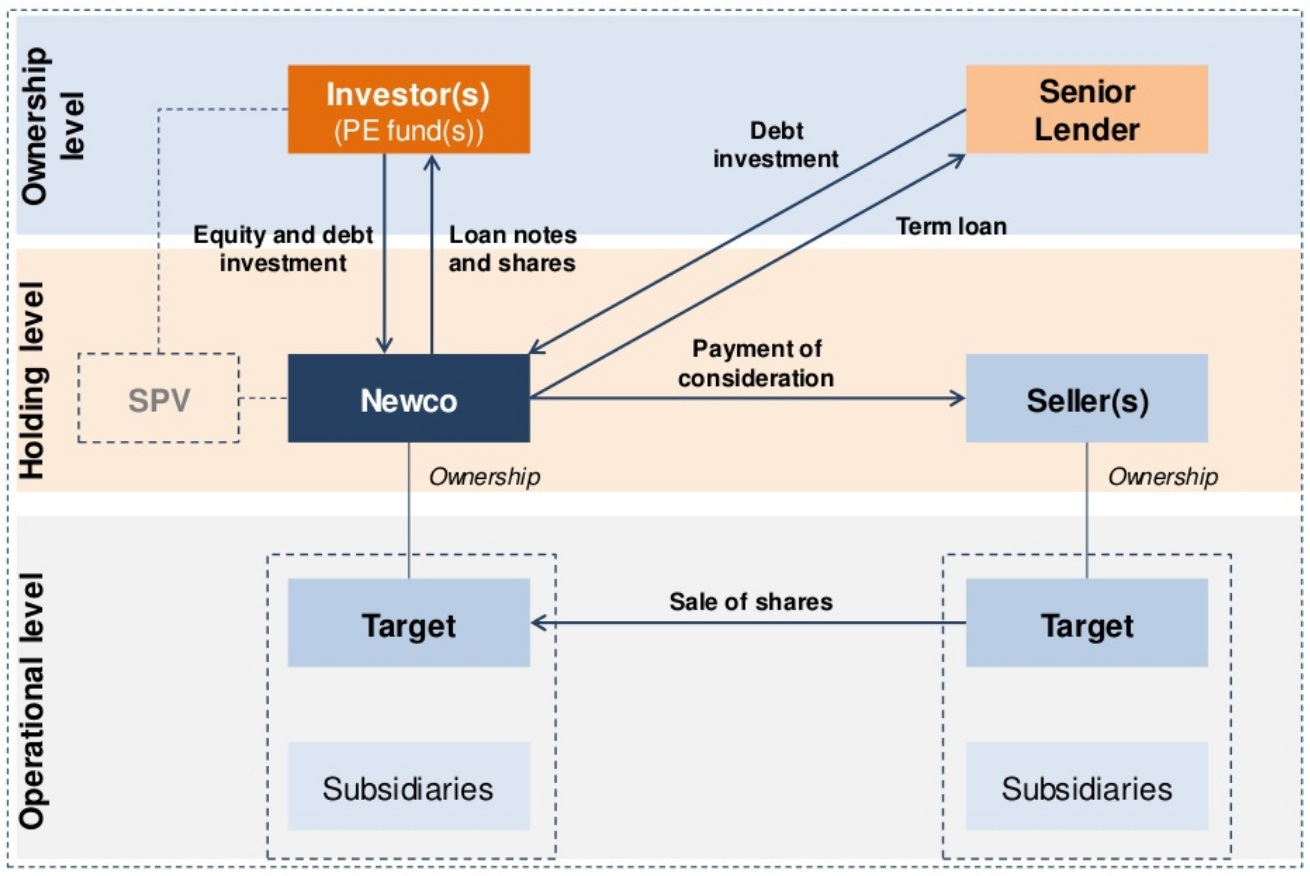

A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money to meet the cost of acquisition.

The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company.

The purpose of leveraged buyouts is to allow companies to make large acquisitions without having to commit a lot of capital.

Understanding Leveraged Buyout (LBO)

In a leveraged buyout (LBO), there is usually a ratio of 90% debt to 10% equity. Because of this high debt/equity ratio, the bonds issued

in the buyout are usually are not investment grade and are referred to as junk bonds. Further, many people regard LBOs as an especially ruthless,

predatory tactic. This is because it isn't usually sanctioned by the target company. It is also seen as ironic in that a company's success, in terms

of assets on the balance sheet, can be used against it as collateral by a hostile company.

LBOs are conducted for three main reasons.

Our specialist team has vast experience in advising all forms of MBOs (MBO, LBO, BIMBO, RAMBO, VAMBO) and MBIs of both private and public companies.

This insight into current market practice ensures we negotiate the best deal for you throughout your transaction. Our team has the experience to help guide and support management teams through the process. We advise management teams on structuring, valuation, financing and tax planning and assist them to approach the vendor with a credible bid.

Our team can engage with you to:

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.