What Is a Management Buyout (MBO)?

A management buyout (MBO) is a transaction where a company's management team purchases the assets and operations of the business they manage.

A management buyout is appealing to professional managers because of the greater potential rewards and control from being owners of the business

rather than employees.

What Is a Management Buy-In?

A management buy-in (MBI) is a corporate action in which an outside manager or management team purchases a controlling ownership stake in an

outside company and replaces the existing management team in place. This type of action can occur when a company appears to be undervalued,

poorly managed or requiring succession.

Management buy-in is also used in a non-financial sense to refer to situations in which employees of a company want to obtain support from management for an idea or project. When management buys in, they have thrown their support behind an idea, which typically makes moving forward with it much easier for employees.

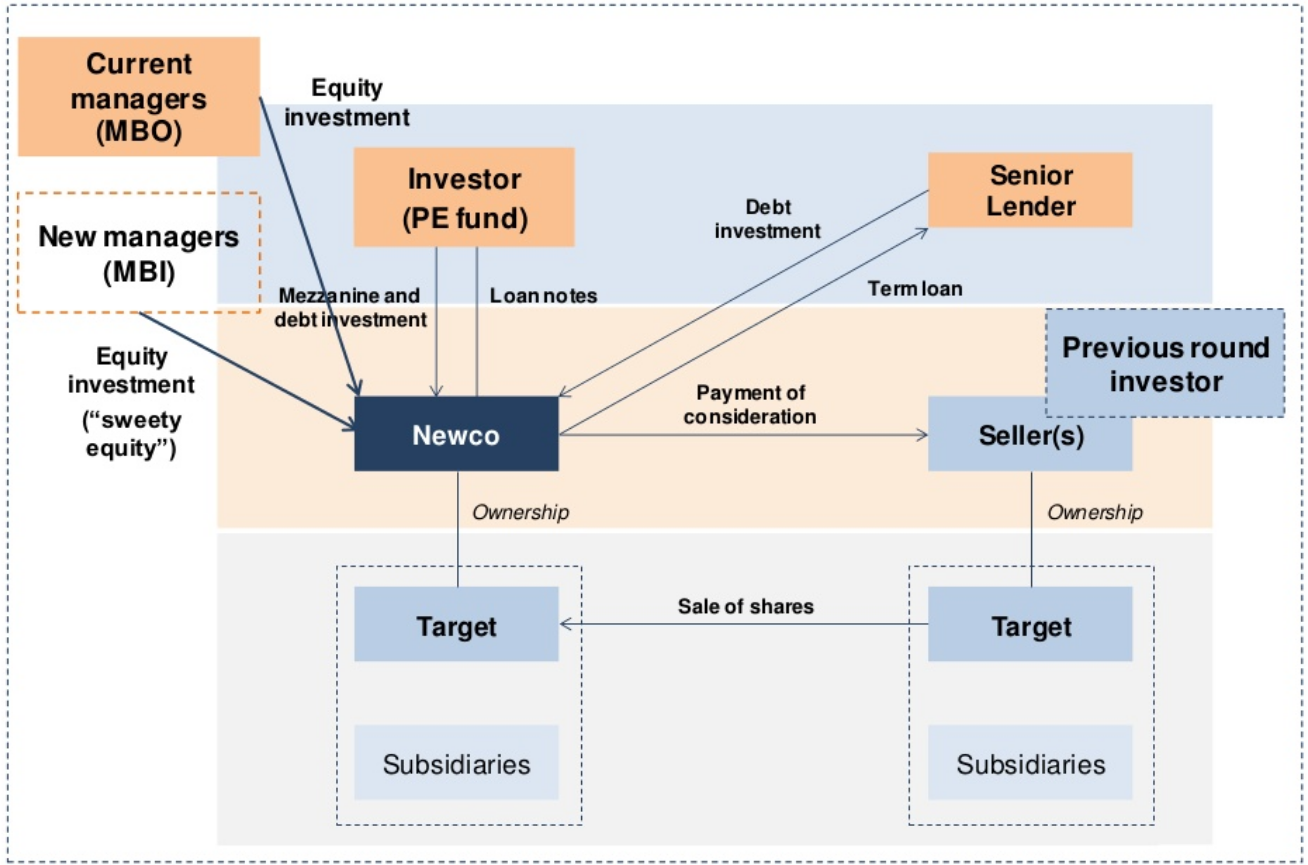

Our specialist team has vast experience in advising all forms of MBOs (MBO, LBO, BIMBO, RAMBO, VAMBO) and MBIs of both private and public companies.

This insight into current market practice ensures we negotiate the best deal for you throughout your transaction. Our team has the experience to help guide and support management teams through the process. We advise management teams on structuring, valuation, financing and tax planning and assist them to approach the vendor with a credible bid.

Management Buyout (MBO) vs. Management Buy-In (MBI)

A management buyout (MBO) is different from a management buy-in (MBI), in which an external management team acquires a company and replaces the

existing management team. It also differs from a leveraged management buyout (LMBO), where the buyers use the company assets as collateral to obtain

debt financing. The advantage of an MBO over an LMBO is that the company's debt load may be lower, giving it more financial flexibility.

An MBO's advantage over an MBI is that as the existing managers are acquiring the business, they have a much better understanding of it and there is no learning curve involved, which would be the case if it were being run by a new set of managers. Management buyouts are conducted by management teams that want to get the financial reward for the future development of the company more directly than they would do as employees only.

Advantages and Disadvantages of Management Buyouts (MBO)

Management buyouts (MBOs) are viewed as good investment opportunities by hedge funds and large financiers, who usually encourage the company to go

private so that it can streamline operations and improve profitability away from the public eye, and then take it public at a much higher valuation down the road.

In the case the management buyout is supported by a private equity fund, the private equity will, given that there is a dedicated management team in place, likely pay an attractive price for the asset. While private equity funds may also participate in MBOs, their preference may be for MBIs, where the companies are run by managers they know rather than the incumbent management team.

However, there are several drawbacks to the MBO structure as well. While the management team can reap the rewards of ownership, they have to make the transition from being employees to owners, which requires a change in mindset from managerial to entrepreneurial. Not all managers may be successful in making this transition.

Our team can engage with you to:

Our experts partner with clients on corporate planning, providing perspective not only on immediate value and impact, but on long-term implications. We work closely with management and other advisers to leverage and complement their knowledge and ensure maximum impact, and actively support implementation and skill building.